Embed carbon accounting into your financial product with Connect Report

Every time a financial institution loans money to a business, they become responsible for a portion of that company’s carbon footprint. For most banks, the financed emissions can be over 10x larger than their operational emissions. It is therefore vital that banks help their customers measure their carbon emissions.

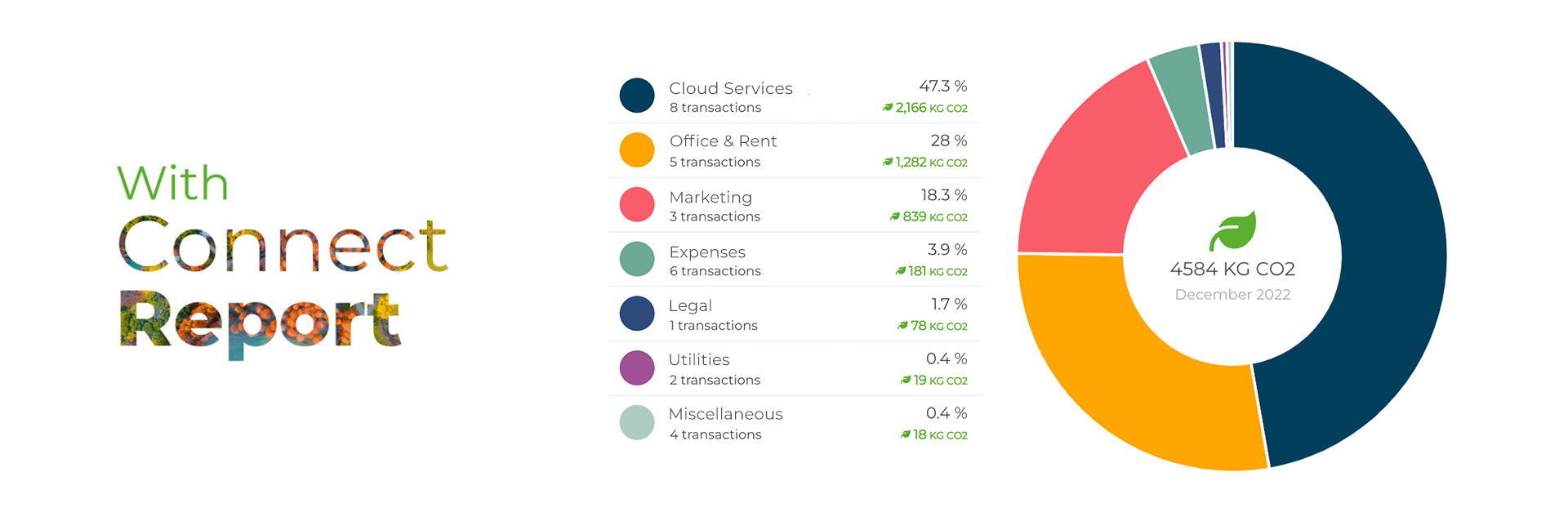

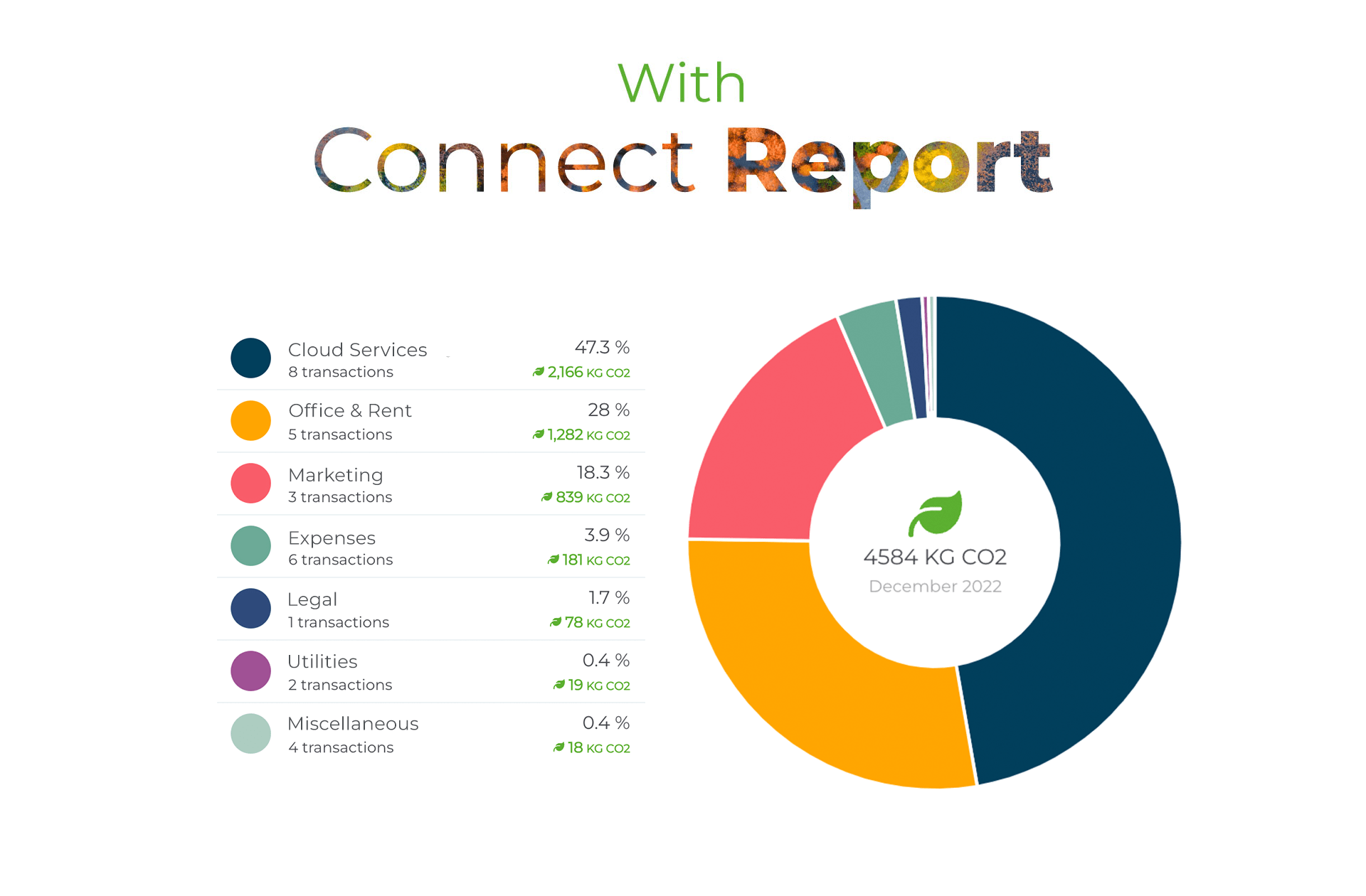

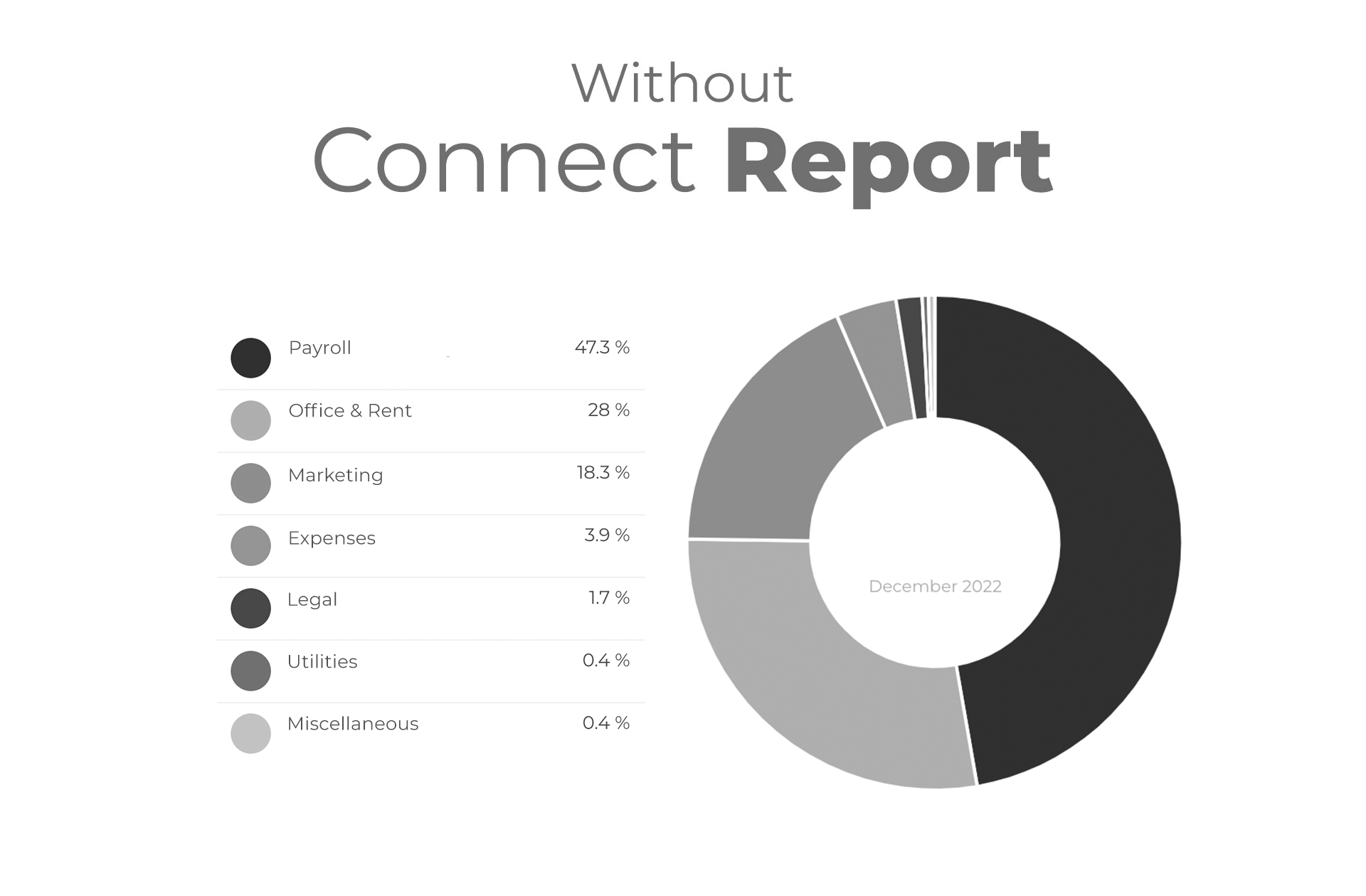

Connect Report is a carbon accounting solution that enables financial institutions to measure the carbon footprint of their SME customers.

Streamline your reporting under the following standards

Helping you keep in line with the following regulations

SUITABLE FOR

-

B2B Banks

B2B Banks -

Commercial Banks

Commercial Banks -

B2B FinTechs

B2B FinTechs

KEY PRODUCT CHARACTERISTICS

-

Step-by-step carbon emissions estimates for your SME customers

Step-by-step carbon emissions estimates for your SME customers -

Analysis of hotspots and main sources of emissions

Analysis of hotspots and main sources of emissions -

Performance benchmarking against the SME’s industry

Performance benchmarking against the SME’s industry -

Tailored reduction recommendations

Tailored reduction recommendations -

Easy-to-read reports tailored to customers, financiers or supply chain partners

Easy-to-read reports tailored to customers, financiers or supply chain partners

HOW IT WORKS

Connect Earth’s carbon intelligence infrastructure supports scalable transactional carbon accounting, blending our AI emissions categorisation engine with spend- and activity-based emissions data.

Committed to providing accessible, scalable, and complete carbon accounting solutions, we support financial institutions’ ESG teams on their journey to measure their financed emissions, drive sustainable financing within their portfolio, and ultimately engage and support customers on their decarbonisation journey.

WHY CONNECT REPORT?

Stay Ahead of Regulation

Harnessing data supports SMEs in navigating through new regulation and mandatory reporting. Non-compliance creates risk for financial penalties.

Strong Stakeholder Relationships

For a multitude of reasons, sustainability commitments and initiatives are increasingly prioritised by investors, employees, and consumers.

Access Green Funding

Through carbon emissions measurement you can provide investors with increasingly valuable information around environmental risks and opportunities.

Gain Competitive Advantage

From generating new business partnerships and improving reputation, there are countless reasons to act now.